Are yall ready for another confession? I know I know I’m always confessing something, but this one is about my journey to graduate school.

This post is inspired and sponsored by College Ave Student Loans. As always all thoughts and opinions are my own.

Unlike most of my graduate school friends, I made the choice to attend grad school on a whim. I was nearing the end of the fall semester of my final year of undergrad and I didn’t really have a plan. I know that’s probably a bit hard to believe, but from the moment I started college my goal was to be a lawyer. That is until two things happened…

First, my GPA was suffering as a political science major. I had a really rough semester emotionally and failed a couple of classes (hello academic probation). One of the classes I failed happened to be in my major, which meant I ‘d have to retake it. However, I just could not sit through that class a second time. It was awful… So, I made the decision to change my major second semester of my junior year to English and instead of graduating in four years, I’d finish in five. I could still go to law school I’d just have to do extremely well on the LSAT and rock my personal statement.

And then I took a practice LSAT the summer before my final year of undergrad, and immediately called my uncle and told him we either needed to hire a personal tutor for me or come up with a new plan for my future. Sensing that I was not ready for law school or the possible rejection, he suggested I consider applying for Master’s programs in English. I’d finish the Master’s and apply to law school afterwards. I had developed a new passion for rhetoric and composition, so this seemed like a win-win. I’d give myself a chance to apply to better ranked law schools with a Master’s degree and I wouldn’t end up back on my parent’s couch.

I applied to two graduate schools in Atlanta and received acceptances for both (well provisionally for one) and decided on the school with the rhetoric and composition program. At this point, my student debt was pretty small. I had a full tuition scholarship throughout undergrad and took out small loans to help with living expenses nothing major. I was also an in-state student, so I didn’t even consider the out of state tuition expenses that came with moving.

Boy was I in for a rude awakening that first semester. I took out the bare minimum I needed to cover tuition and living expenses, but then I was literally struggling to eat. Eventually, I started taking out more without thinking about the long term. Plus, I didn’t really know my options since my parents didn’t attend graduate school and finances were not something we discussed beyond budgeting for groceries and learning to balance my checkbook. I did like most students and utilized our campus financial aid office, and like most public schools you’re encouraged to use the government’s loan program.

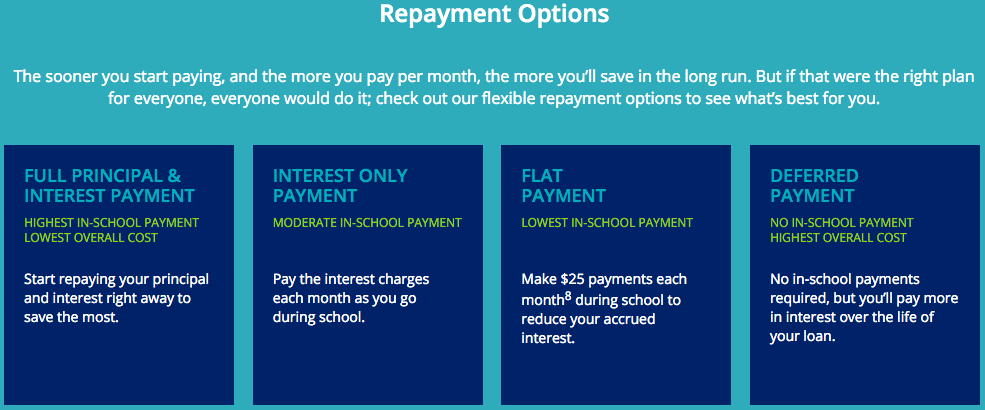

Now that I’m nearing the end of my studies there are so many things I wish I had done differently, specifically student loan debt. As I’m sure you’re aware there are many students out there just like me and while changes seem to be heading our way, we still need better alternatives when it comes to borrowing money for education. College Ave Student Loans is one wonderful alternative because they allow you the opportunity to pay your interest while you’re still in school.

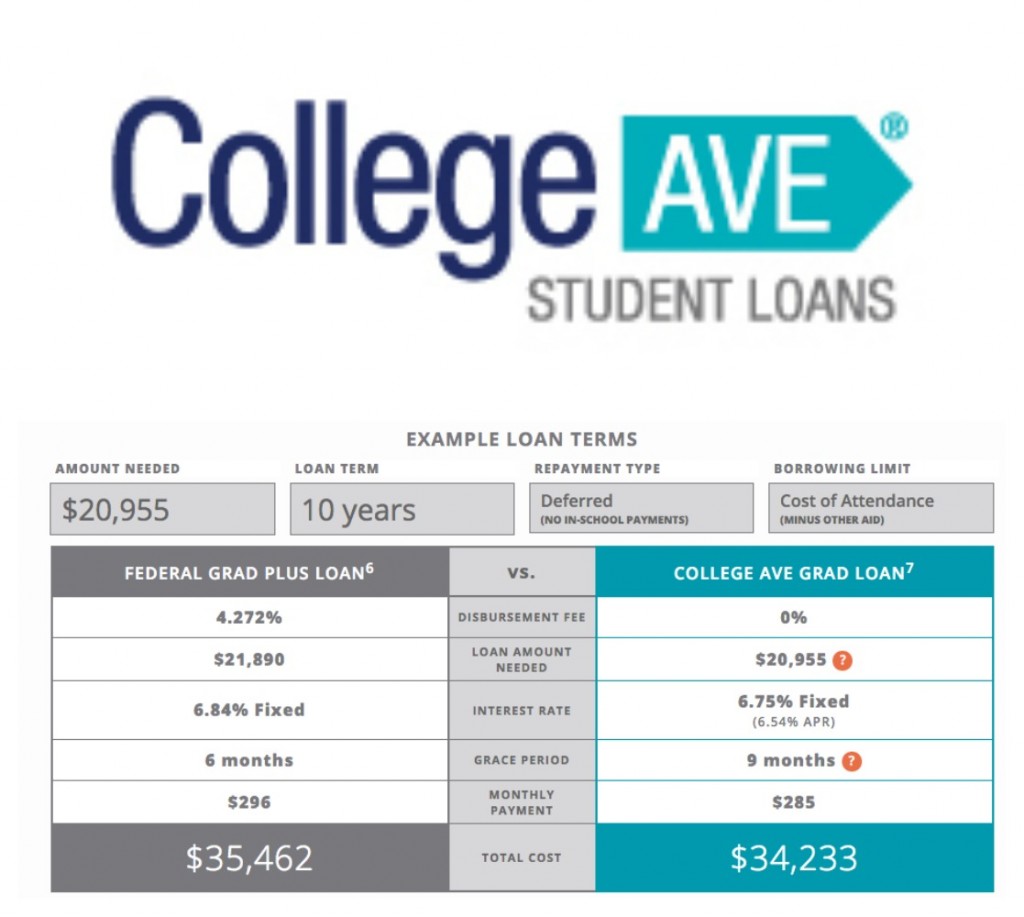

College Ave is a leading online marketplace for student loans and recently announced a graduate student focused loan option. They offer qualified graduate students an average savings of over $1,200 compared to the Federal Direct Plus program. Credit-qualified graduate students can expect a lower fixed interest rate than the Federal Direct Plus loan and no origination fee. You can also count on a 9 month post-graduate grace period unlike the 6 month grace period from Federal Direct Plus. Head on over to College Ave and check out their Grad Calculator and Pre-Qualification Tools.

This is a sponsored post written by me on behalf of College Ave Student Loans.